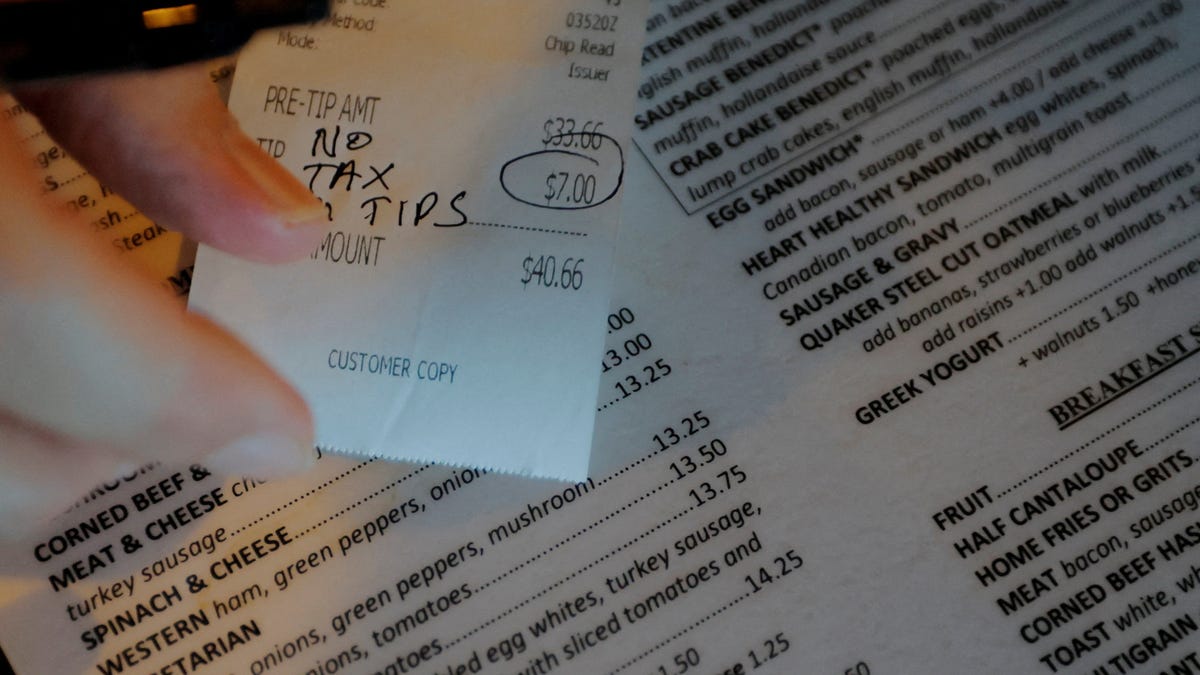

Taxpayers who want to claim some attractive new income tax deductions that were packed into the One Big Beautiful Bill Act will need to keep their records — and get ready to file yet another form to claim tax breaks on tips, overtime pay, car loan interest and more.

An early draft copy of a new, two-page, federal income tax form called Schedule 1-A has been released by the Internal Revenue Service.

Schedule 1-A will be filed with 2025 federal income tax returns that will be filled out next year to claim:

All four of these new deductions are available to eligible taxpayers whether they itemize deductions, such as claiming mortgage interest, or claim the standard deduction.

But remember, income limits and other restrictions also apply to these limited tax breaks, which all currently run from 2025 to 2028.

You’ll want to keep track of a long list of details associated with these tax breaks as we get closer to year-end. The draft for Schedule 1-A gives some specifics.

To claim the new deduction on car loans on the 2025 tax return you file next year, for example, the schedule includes a spot where you’ll need to list the vehicle identification number associated with the car loan being claimed. To claim a tax break on the 2025 return, the auto loan must be taken out in 2025 to buy a new car with its final assembly in the United States. The tax break will not apply to car loans taken out to buy a used car — or new cars or new trucks with final assembly outside of the United States.

Seniors are looking at seven lines on that draft schedule just associated with the “enhanced deduction for seniors.” Those who are age 65 and older may claim an additional deduction of $6,000 beginning on 2025 returns. But higher income seniors receive a smaller tax break or no tax break because the deduction starts phasing out for those with a modified adjusted gross income of $75,000 for singles and $150,000 for joint filers.

All four of these tax deductions created in the One Big Beautiful Bill Act, which was signed into law by President Donald Trump on July 4, will be treated as what’s called a “below-the-line deduction.”

What it means: You’ll be able to reduce your taxable income. But you won’t be reducing your adjusted gross income when you claim these special deductions, said Tom O’Saben, an enrolled agent and director of tax content and government relations for the National Association of Tax Professionals.

Above the line? Below the line? It all sounds like somebody is ready to cross some line. But the distinctions are essential in the tax universe.

Early on, some experts initially thought some new deductions in the mega tax bill could be above-the-line tax breaks. But they won’t be.

What’s the difference? It’s not quite like heaven and Hades. But it’s close. Above-the-line is better for many people; below, not so pleasant for some.

A below-the-line deduction — which is how car loan interest, tips and some other new breaks will be treated — is subtracted after your adjusted gross income has been determined. It will not reduce your AGI and not help you tap into some credits or other tax breaks.

In general, O’Saben noted, above-the-line deductions are often more valuable because they reduce your adjusted gross income, making some people more likely to be eligible for other tax breaks and benefits that phase out once you hit higher AGI levels.

“While less advantageous than the above-the-line deduction since it does not reduce AGI, the below-the-line deduction is available to taxpayers whether they itemized deductions or not, unlike an itemized deduction,” said Mark Luscombe, principal analyst for Wolters Kluwer Tax & Accounting in Riverwoods, Illinois.

Only roughly 10% of taxpayers now itemize their deductions; most people claim the standard deduction.

So, it remains welcome news that “no tax on tips,” the deduction for car loan interest and other new deductions won’t just apply to those who itemize.

But if you’re expecting to lower your AGI by claiming one of these new Big Beautiful Bill tax breaks, forget about it.

Lowing your AGI can unlock several additional tax benefits, O’Saben said, such as the earned income tax credit, the child tax credit and education credit that have income limitations.

Your ability to claim some deductions, like medical expenses, depends a great deal on your AGI. If you itemize your deductions for a taxable year on Schedule A, the IRS notes, you may be able to deduct the medical and dental expenses you paid to the extent these expenses exceed 7.5% of your adjusted gross income for the year. A lower AGI would make it easier to exceed the threshold.

In addition, contribution limits or deductibility for IRAs and other retirement plans depend on AGI. A high AGI can increase the cost of Medicare Part B and D premiums.

Taxpayers already are taking a below-the-line deduction on the 1040 form — after calculating their adjusted gross income — when they claim the standard deduction or itemized deductions, such as mortgage interest and charitable contributions.

As we get closer to tax season, we’ll be hearing more clarifications about how taxpayers can expect to claim the new deductions for tips, overtime, seniors and car loan interest.

The draft Schedule 1-A, according to Luscombe, sets forth various requirements for each new deduction, some of them appearing in the calculation itself on the form.

“Instructions for Schedule 1-A have not yet been released and may provide some additional helpful guidance,” Luscombe said.

Some clarity, for example, was released by the IRS and the Treasury Department on Sept. 19 regarding how some tips will be treated.

The tax break applies to cash tips, not gifts received. But Treasury spelled out that those tips could be given by check, credit card or debit card or even gift cards and still count as a “cash tip.”

A casino chip given as a tip would count toward a tax deduction, according to a Treasury official, as tangible or intangible tokens that are easily exchanged for a fixed amount in cash would be covered.

Most digital assets, such as bitcoin, would not count as a cash tip that can be claimed under the new tax deduction. These digital assets will see their value constantly fluctuating.

The general definition of “cash tip” for this tax break includes tokens readily “exchangeable for a fixed amount in cash.”

More: What jobs are eligible for ‘no tax on tips’ in 2025? Preliminary list might surprise you

More: ‘No tax on overtime’: When it will work for you and when you’ll still pay taxes

More: Trump’s new tax deduction on auto loans has major limitations: What car buyers should know

As a result, a newer digital currency known as stablecoins would qualify for the deduction because they don’t see fluctuating values and tend to be exchangeable for a fixed amount. Stablecoin is type of cryptocurrency tied to the value of an asset like the U.S. dollar.

Also, Treasury clarified that these tips must be received as part of legal transactions — and not for illegal activities, such as prostitution. Tips relating to pornographic activity, according to Treasury, also would not qualify for the tax break.

Qualified tips must be reported on a “Form W-2, Form 1099, or other specified statement furnished to the individual or reported directly by the individual on Form 4137,” according to IRS guidance.

The tip income needs to be reported on the return. Then, the tax filer will need to fill out the form for “additional deductions” and claim qualified tip income received in the year.

The maximum annual deduction for tip income is $25,000 per return.

The deduction reduces your taxable income. According to an example given by the Bipartisan Policy Center, a single taxpayer earning $50,000 — including $5,000 in tips — could save $600 with the new tax deduction on tip income.

Employers still are required to withhold taxes from each paycheck for Social Security and Medicare, which are referred to as FICA or payroll taxes. Workers still must report all tips to their employers if they total $20 or more in a single month.

The IRS and the U.S. Treasury Department has issued an updated list of nearly 70 occupations that “customarily and regularly received tips” on or before Dec. 31, 2024, that will apply to the tip-related tax deduction.

The most recently released list includes bartenders, water taxi operators, home movers, golf caddies, valet attendants, casino dealers, clowns, pizza delivery drivers, hair stylists, shampooers, and more.

In an update released Sept. 19, the IRS and Treasury indicated that qualified tips can be received from customers through a tip pool.

As part of the Sept. 19 news, the Treasury and IRS noted that comments from the public can be submitted within 30 days through Regulations.gov. Comments on the proposed regulations are due by Oct. 23.

Luscombe said the invitation for comments on the deduction for tip income indicates that the IRS is probably open to considering some additions to its list of occupations for qualified tip recipients.

And yes, all tips will not qualify for the “no tax on tips” break.

Those with higher incomes will receive a smaller tax break or none at all, depending on their income. The deduction relating to taxes on tips phases out, or gets smaller, for taxpayers with modified adjusted gross income over $150,000 if single or above $300,000 for married couples filing a joint return.

The “no tax on tips” deduction is not available for taxpayers who claim married filing separately.

Taxpayers must include a valid Social Security number on the return.

What won’t change: Tips will not qualify for the deduction if they are received in the course of certain specified trades or businesses — including the performing arts, health, athletics and other professional occupations, like law, brokerage services and accounting, according to the Treasury Department.

As I reported in early August, some waitstaff at restaurants that have mandatory tip policies will be shocked to discover that a big chunk of their tip income won’t qualify for a tax break.

Tips must be paid voluntarily by the customer and not be subject to negotiation, according to a Treasury official.

Automatic service charges or automatic gratuities that a customer has no discretion to modify or disregard are not going to be viewed as “qualified” tips for the tax break, according to a Treasury official. The tips must be voluntary, not mandatory.

Specifically, the IRS and Treasury referred to an example of a restaurant that imposes an automatic 18% service charge for large parties and distributes that amount to waiters, bussers and kitchen staff.

“If the charge is added with no option for the customer to disregard or modify it, the amounts distributed to the workers from it are not qualified tips,” according to IRS and Treasury guidance issued Sept. 19.

The new, special tax deduction on tips is retroactive and applies to eligible tip income earned in all of 2025 — going back to Jan. 1.

Of course, the mega tax bill passed this summer, and many employers likely didn’t update their systems for recording tip income early in the year with expectations of the new tax rules. More guidance will be ahead for the transitional tax year when people file 2025 income tax returns in 2026.

Contact personal finance columnist Susan Tompor: stompor@freepress.com. Follow her on X @tompor.