Don’t have an account? Subscribe

“Our goal is to help stakeholders understand the future of mobility.”

Home › News Releases ›

Europe’s new passenger car market up 5.0% in August

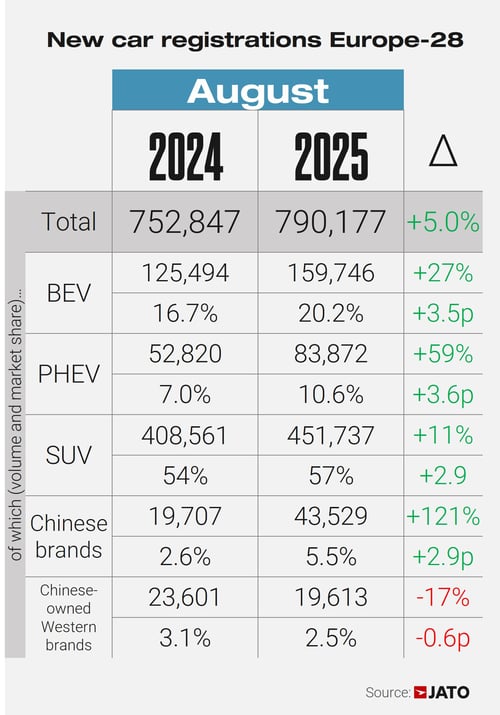

August was a positive month for Europe’s new passenger car market. According to JATO Dynamics’ data, a total of 790,177 units were registered in Europe-28* in August 2025, up by 5.0% year on year. Last month’s growth was mostly driven by Germany (+5.0%), Poland (+15%), Spain (+18%) and Austria (+25%).

The growth witnessed in the market last month can be partly attributed to an uptick in registrations of battery electric vehicles (BEVs), up 27% compared to August 2024. This resulted in a new record market share for the segment of 20.2%, up by 3.6 percentage points. So far in 2025, 1.54 million BEVs have been registered in Europe.

“The data shows that there was strong demand for BEVs in August, however a 27% increase is less significant than it looks when you consider how widely they are being promoted across Europe,” said Felipe Munoz, Global Analyst at JATO Dynamics. “The new record market share for BEVs achieved last month has been partly distorted by the fact that Italy – typically a less enthusiastic adopter of BEVs – is usually quiet during August,” Munoz continued.

Plug-in hybrid vehicles (PHEVs) had an even more impressive month. 83,900 units were registered in August, with volumes increasing by 59% year on year and the powertrain’s market share rising to 10.6%. Facing higher tariffs on BEV imports to Europe, Chinese car brands are now boosting their presence in the PHEV segment. Registrations increased from just 779 units in August 2024 to 11,064 units last month, with BYD now the eighth best-selling brand for PHEVs. The top ten PHEV ranking included three Chinese models: the BYD Seal U, the Jaecoo J7 and the MG HS.

More than 43,500 units were registered by Chinese car brands in August – a 121% year-on-year increase and more than the individual volumes recorded by several major European brands. Combined registrations of Chinese car brands last month were higher than those of Audi (41,300 units) and Renault (37,800 units). Although registrations by Chinese car brands comprise 40 different brands, the top five players (MG, BYD, Jaecoo, Omoda, Leapmotor) account for 84% of the total.

By brand, MG registered more new cars than both Tesla and Fiat last month, BYD was ahead of Suzuki and Jeep, and Jaecoo and Omoda outsold brands including Alfa Romeo and Mitsubishi. “European consumers are responding positively to the growing, competitive line-up from China’s car brands,” Munoz continued. “It appears that these brands have successfully tackled the perception and awareness issues they have experienced.”

Volkswagen’s B-SUV, the T-Roc, was Europe’s most registered SUV between January and August and topped the model ranking for August with almost 14,700 units, up by 14%. This result is even more remarkable considering that this model has been on the market for eight years and the second generation has just been revealed.

ts larger brother, the Volkswagen Tiguan, also recorded solid results, coming in at fourth place with volumes up by 23%. Meanwhile, its direct rival the Hyundai Tuscon secured sixth place in the ranking, with registrations up by 28% year on year.

Despite year-on-year registrations of the Tesla Model Y dropping by 38%, it confirmed its position as Europe’s preferred electric vehicle between January and August this year.

*Austria, Belgium, Czechia, Croatia, Cyprus, Denmark, Estonia, France, Finland, Germany, Greece, Hungary, Ireland, Italy, Lithuania, Latvia, Luxembourg, Netherlands, Norway, Poland, Portugal, Romania, Sweden, Spain, Switzerland, Slovakia, Slovenia, UK.

SOURCE: JATO Dynamics

September 23, 2025

September 23, 2025

September 23, 2025

Let us help you understand the future of mobility

"*" indicates required fields

February 3, 2026

Explore the business models, technologies, and trends shaping the future of electric mobility. Tickets for this in-person event are limited, so please book early.

February 4, 2026

Explore the business models, technologies, and trends shaping the future of the software-defined vehicle. Tickets for this in-person event are limited, so please book early.

February 5, 2026

Explore the business models, technologies, and trends shaping the future of autonomous mobility. Tickets for this in-person event are limited, so please book early.

Welcome back , to continue browsing the site, please click here