US states fund most of their road and infrastructure budgets with revenues from gasoline taxes. The historical rationale behind this is intuitive. The more people use public roads, the more gasoline they consume, making the gas taxA gas tax is commonly used to describe the variety of taxes levied on gasoline at both the federal and state levels, to provide funds for highway repair and maintenance, as well as for other government infrastructure projects. These taxes are levied in a few ways, including per-gallon excise taxes, excise taxes imposed on wholesalers, and general sales taxes that apply to the purchase of gasoline. a well-designed user feeA user fee is a charge imposed by the government for the primary purpose of covering the cost of providing a service, directly raising funds from the people who benefit from the particular public good or service being provided. A user fee is not a tax, though some taxes may be labeled as user fees or closely resemble them..

As the market share of electric vehicles (EVs) on the road grows, however, the gas taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.’s ability to fund road projects and decrease traffic congestion erodes. Both federal and state real tax revenue per vehicle mile traveled has been on a steady decline for decades, creating a fiscal gap for road expenditures even as the demand for road infrastructure improvements has grown.

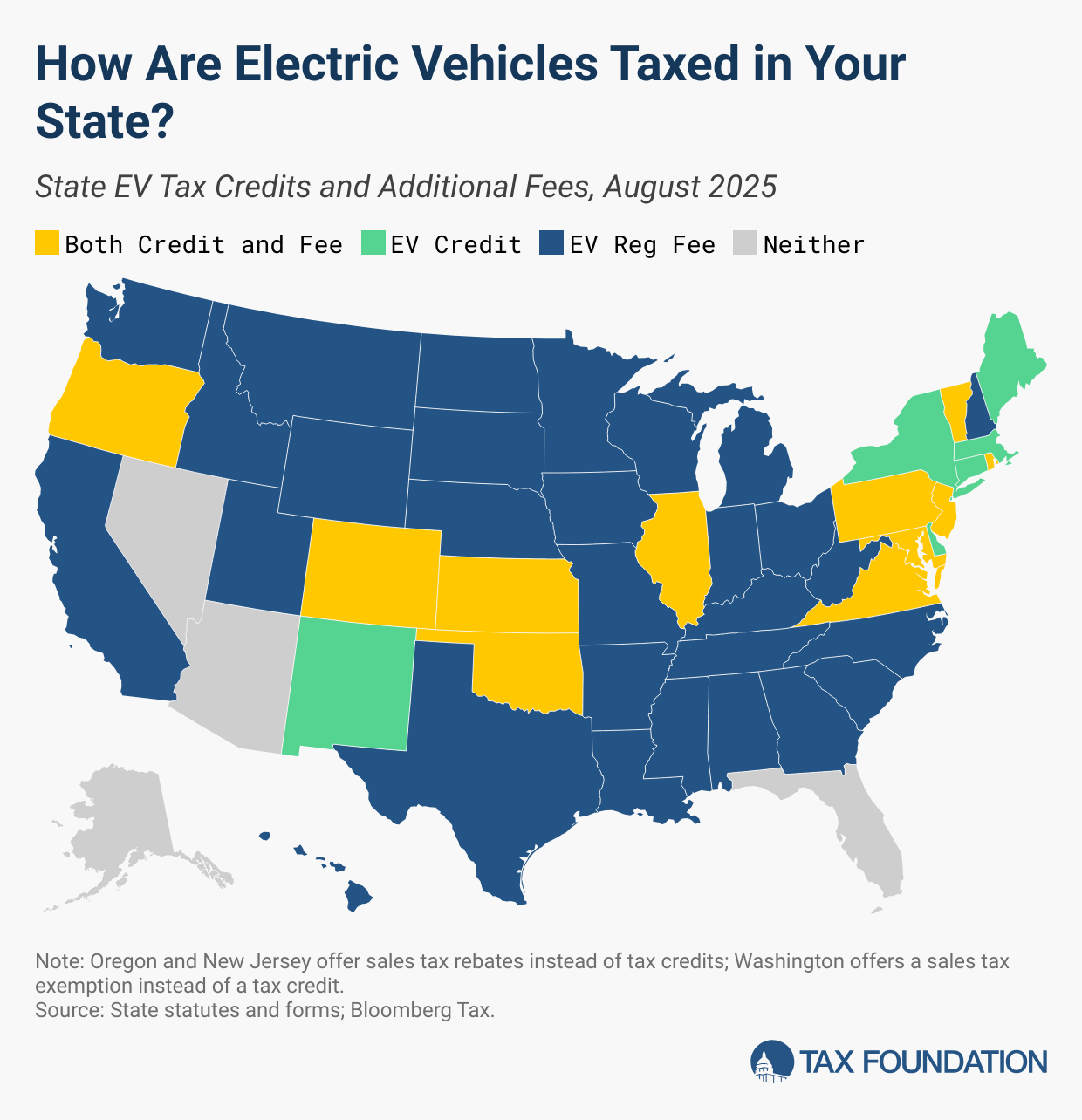

Tax treatment of EVs is complicated. EVs generate lower emissions than traditional combustion engine vehicles, suggesting tax-preferred status from an environmental perspective. Because EV users don’t pay gas taxes for their road use, however, separate fees and taxes may be needed to put EV road use on a more level status with traditional vehicle road use. Combining the fiscal gap with a desire to incentivize lower-emission vehicles, states have responded with a variety of tax policies.

The following map depicts states’ different approaches to incentivizing EV adoption and the imposition of higher registration fees for EV ownership.

Data compiled by Brayden Myers , Jacob Macumber-Rosin, Adam Hoffer

Data compiled by ,

For several years, residents of all states have been eligible to receive a federal tax credit of $7,500 for qualified EV purchases. However, this tax credit ends for vehicles purchased after September 30, 2025. Seventeen states offer an additional incentive beyond the federal credit, ranging from a $1,500 incentive in Rhode Island to a $7,500 credit in Oregon and Maine.

Contrary to a tax incentive, 40 states impose a higher annual vehicle registration fee for EVs and some hybrid vehicles to help offset forgone gas tax revenue. These fees range from $50 in Hawaii and South Dakota to $260 in New Jersey. These, however, have generally been justified as modest efforts to defray the lack of gas tax collections from EVs, which may be more environmentally friendly, but still put wear and tear on roads.

Eleven states both offer an incentive for the purchase of an EV and impose a higher registration fee for EVs than for combustion engine vehicles. The table below summarizes these policies.

Another response by states to backfill reductions in gas tax collections has been to implement a tax on EV charging stations. States like Georgia, Iowa, Kentucky, and Oklahoma impose a tax per kilowatt-hour distributed by charging stations. While this added user fee may help equalize treatment between combustion engines and EVs, because many users charge their EVs at home, these taxes can fail to fully account for EV road use.

Higher registration fees and EV charging station taxes are an attempt to better connect vehicle miles traveled (VMT) to transportation and road funding, yet in some instances, they are implemented in conflict with policies aimed at increasing EV adoption. A simpler transportation policy solution would be a VMT tax.

A VMT tax is levied on the number of miles traveled by an individual vehicle. This is usually done by odometer reading or through a GPS device. While there are privacy concerns with the use of GPS devices to track VMT, relying purely on odometer readings can result in drivers being charged for miles driven outside of the taxing state.

Moreover, as devices and apps used by insurance providers to track safe driving become commonplace, similar tools could be used to directly link the miles traveled to public road and infrastructure spending in the proper jurisdiction.

Currently, four states have active VMT tax programs:

Vermont was expected to begin a similar program in 2025, but implementation has been postponed to 2027. Additionally, California and Washington have run significant VMT pilot programs.

The state EV taxation landscape reflects the evolving transportation sector and the pressing need to address both fiscal gaps in road funding and environmental concerns. As the EV market continues to evolve and technology advances, it’s likely that tax policies will also adapt.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Nebraska has an opportunity to revise the property tax package enacted in 2024 to ensure that Nebraskans enjoy meaningful property tax relief.

Growing cigarette tax levels and differentials have made cigarette smuggling both a national problem and a lucrative criminal enterprise.

Due to the peculiar design of the proposed tax increase, it’s true: the largest tax increase Oregon has ever seen would create a substantial budget shortfall.

Stay informed on the tax policies impacting you.

About

Since 1937, our principled research, insightful analysis, and engaged experts have informed smarter tax policy in the U.S. and internationally. For over 80 years, our mission has remained the same: to improve lives through tax policies that lead to greater economic growth and opportunity.

Donate

As a nonprofit, we depend on the generosity of individuals like you.

CBD drops and [url=https://www.cornbreadhemp.com/collections/thc-drinks ]weed drinks[/url] prepare a cleanly, routine flavor and settle with a precise dropper after accurate serving sizes. The bottle is firm and travel-friendly. I be aware the straightforward labeling and the inclusive award of the product.

I decided to try https://www.cornbreadhemp.com/collections/thc-gummies effectively of interference after hearing so many people talk prevalent it. The test has been smooth and serene to assimilate into my routine routine. The configuration is light, and the flavor is mild compared to other oils I’ve tried. I appreciate how uncluttered the dosing is and how handy the packaging feels.