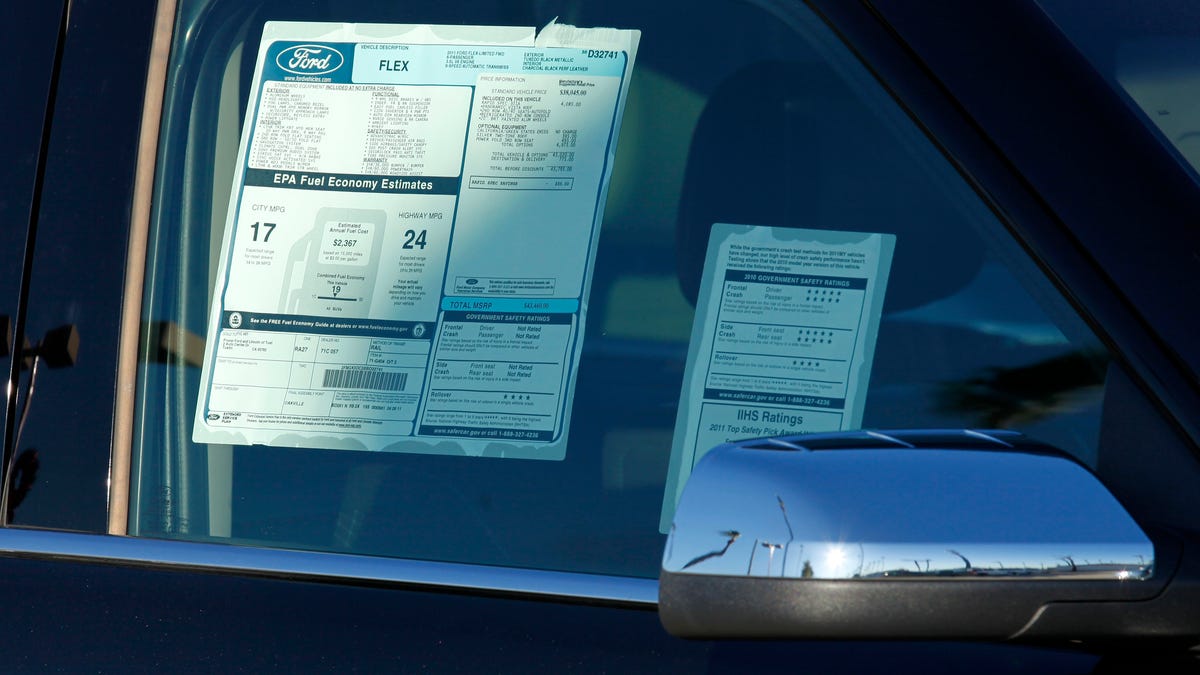

Automakers are tacking on price hikes to new vehicles in a way that consumers are likely to not notice as much as they might if the companies raised the actual manufacturer’s suggested retail price, more commonly called the sticker price.

The carmakers are boosting a mandatory fee listed on the window sticker: the destination and delivery charge.

The destination and delivery charge is a nonnegotiable fee set by the car company that is typically not mentioned in advertising. It covers the manufacturer’s cost to transport the vehicle from the factory to the dealership, but make no mistake, even if you drive to the factory to get the car yourself, you’ll still on the hook to pay that fee.

According to data the Detroit Free Press requested from Edmunds, the destination charges across nearly all automakers have increased at a faster rate for the 2025 model year than during any other time in at least a decade. Within the past year, the Detroit automakers have increased the destination charge across their pickup lineups for GMC, Chevrolet, Ford and Ram brands, from $1,995 in the past to $2,595 for 2026 models.

In fact, the last time the average destination fee was less than $1,000 was back in 2017.

“I have seen those destination fee increases that are out of the norm versus the typical annual adjustments,” Ivan Drury, director of insights at Edmunds, told the Detroit Free Press of recent hikes in destination charges. “Almost everyone is guilty in part on some level because of tariff/inflation and hedging their bets. There is only one vehicle with a destination fee below $1,000 for the 2025 model year, the BMW ALPINA XB7 (SUV). I think they just forgot to increase it due to the niche nature.”

Edmunds data showed, for example, the destination fee for a light duty 2023 Ford F-150 pickup was $1,795. For a 2024 model year, it rose to $1,995, and for 2025 model year, it is $2,595. A Chevrolet Silverado 1500 rose from $1,895 for model year 2023 to $1,995 for 2024 model year and $2,195 for 2025 model year.

Drury said by rolling a cost increase into the destination free instead of upping the MSRP, it means the dealer eats the added cost of tariffs more than the carmaker.

Also, “the factory can still put that additional cost behind an asterisk and ‘starting at’ along with destination fee is something a dealer can explain increased cost on, even if there is no change or minimal change on a vehicle from one model year to the next,” Drury said.

While the increases of late are “out of the norm,” automakers have been adjusting the fees for years, especially the domestic brands, Drury said. In the past four years, the Detroit Three have raised destination fees by a greater percentage than other mass market automakers.

General Motors and Ford Motor have increased destination fees on average by nearly 40% in those four years and Stellantis by nearly 33%.

The data showed that BMW, Mercedes-Benz and Volkswagen have the lowest destination charges across the industry. Whereas Stellantis is the highest with an average destination fee at $2,088. Porsche followed at $1,995. GM and Ford also charged more than the industry average at $1,750 and $2,024, respectively.

The fee hike is partly a response to growing transportation costs due to inflation, analysts said. Plus, depending on the vehicle mix, the popular, bigger vehicles can cost more to ship than small vehicles.

But the increase in the fees has been most dramatic since March when President Donald Trump imposed 25% tariffs on all imported cars and car parts, analysts said. A tariff is a tax paid by an importer when a good crosses a border. Since domestic brands sell some vehicles here that they build in other countries and they use parts imported from other countries on the vehicles built here, the tariffs are inescapable. They are adding billions to automakers’ costs and analysts have said, at some point, part of those costs would have to be passed on to consumers.

Edmunds data showed that the 2025 Buick Envision, which GM makes in China and sells in the states, now has a destination fee of $1,895 compared with the 2023 model year and 2024 model year destination fee of $1,395. The 2025 Ford Bronco Sport, assembled in Mexico, saw its destination fee rise by $400 to $1,995 compared with 2023 and 2024 model years. Then again, the 2025 Dodge Durango, which Stellantis builds in Detroit, also saw a boost in its destination fee to $1,995 compared with $1,595 for model years 2023 and 2024.

“They are hiding some of the tariff costs in the destination charge,” said Sam Abuelsamid, vice president of market research at Telemetry. “Because you can’t opt out of the delivery charge even if you live next to the factory and pick your vehicle at the gate. It should just be part of the price.”

Abuelsamid said rather than raising the manufacturer’s suggested retail prices (or in most cases lower MSRP increases) the domestic brands in particular are jacking up destination charges.

“In the last nine months, Ford, GM and Stellantis have raised the fees two times on large trucks and SUVs from $1,995 at the start of the year to $2,195 sometime in the spring to $2,595 in about September,” Abuelsamid said. “They’ve also raised those fees on smaller vehicles.”

The destination fee for the 2025 Ford Maverick went from $1,595 last year to $1,695 this year. For the 2025 Ford Ranger pickup, it went from $1,595 to $1,895, Edmunds’ data showed. The Maverick is made in Mexico, the Ranger in Michigan. The Lincoln Navigator, made in Kentucky saw its destination fee rise from $1,995 last year to $2,195 this year.

“These fees are generally not included in advertised prices (except by GM) and cannot be avoided,” Abuelsamid said.

Indeed, Drury warned that it can be “a bit tricky to use destination fees to cover costs” because the fee is seen as a nonnegotiable part of a car purchase, so if this fee increases and is charged to the dealership, “then any discount required to sell the vehicle comes out of the dealership’s pocket.”

More: Are Trump policies bringing car prices down? We put it to the experts

When asked about the increases in destination fees and what’s driving them, GM spokesman Kevin Kelly declined to comment.

Stellantis spokeswoman Jodi Tinson told the Detroit Free Press in an email: “Stellantis’ vehicle destination charges are competitive with other automakers that sell large full-size trucks and SUVs.”

Edmunds most recent data showed the 2025 heavy-duty Ram pickup and the Super Duty F-Series made by Ford carry the same destination charge of $2,095. The heavy-duty GMC Sierra and Chevrolet Silverado by GM tack on a fee of $2,195 for the 2025 model year. All of them are $100 to $200 more than the destination charge on a 2024 model. For 2026 models, Drury said the destination fee is $2,595 across all three automakers pickups regardless of size.

Ford spokesman Said Deep in an email said of Ford’s fee increases: “These charges, which reflect factory to dealer vehicle shipping costs, are reviewed and adjusted as necessary to keep consistent with the industry.”

Other data indicates that consumers will not be getting a break from steep new car prices any time soon.

On Dec. 10, Kelley Blue Book released its November estimate for the average transaction price for a new vehicle in the United States. An average transaction price is what the consumer pays after all discounts and trade-in offers have been applied.

Kelley Blue Book, which is owned by Cox Automotive, said the average transaction price for a new car in November was $49,814, a 1.3% increase over the year-ago period and roughly unchanged from October’s $49,760. Kelley Blue Book said the high average transaction price reflects a market “heavily influenced by affluent households.”

More: Report signals a call to action for Michigan’s auto industry

Also, prices are expected to move higher this month, as new-vehicle prices typically peak in December because of a wider mix of expensive vehicles being sold.

“Our average price for a new vehicle in the U.S. is holding near $50,000 and showing no signs of coming down,” said Cox Automotive Executive Analyst Erin Keating. “It’s important to remember, though, that the KBB ATP is a measure of what is bought, not what is available. Nearly half of new-vehicle buyers are over the age of 55 and in their peak earning years. These buyers are more likely shopping for a high-end SUV, not something cheap and cheerful. In November, the over-$75,000 price point saw more volume than under-$30,000.”

Automakers offered lower incentives, too. Kelley Blue Book said the average incentive package in November was equal to 6.7% of the average transaction price or $3,347. That’s down notably from November 2024 when incentive spending was at a three-year high of 7.9% of the average transaction price.

Jamie L. LaReau is the senior autos writer for USA Today Co. who covers Ford Motor Co. for the Detroit Free Press. Contact Jamie at jlareau@freepress.com. Follow her on Twitter @jlareauan. To sign up for our autos newsletter. Become a subscriber.