With Rachel Reeves delivering the budget tomorrow, we look at how her reported decision on salary sacrifice schemes could affect you. Tell us what announcements you’d like to see in the budget below.

Tuesday 25 November 2025 13:20, UK

Rachel Reeves is expected to announce a smorgasbord of tax rises at the budget tomorrow but one decision in particular has really got people talking: a reported tax raid on salary sacrifice schemes.

Concerns have been raised that such a move could put people’s retirements at risk and push them into paying more tax.

Money Clinic podcast host Claer Barrett warned her Instagram followers that younger workers’ prospects of saving for a decent retirement would be “decimated” and it would be particularly bad for working parents who are trying to stay below “horrible cliff edges in the tax system”.

But it’s not just pensions that could be affected.

Here we explain what salary sacrifice is, how it works, what Reeves is reportedly considering and why all of that is important for the money in your pocket.

What is salary sacrifice?

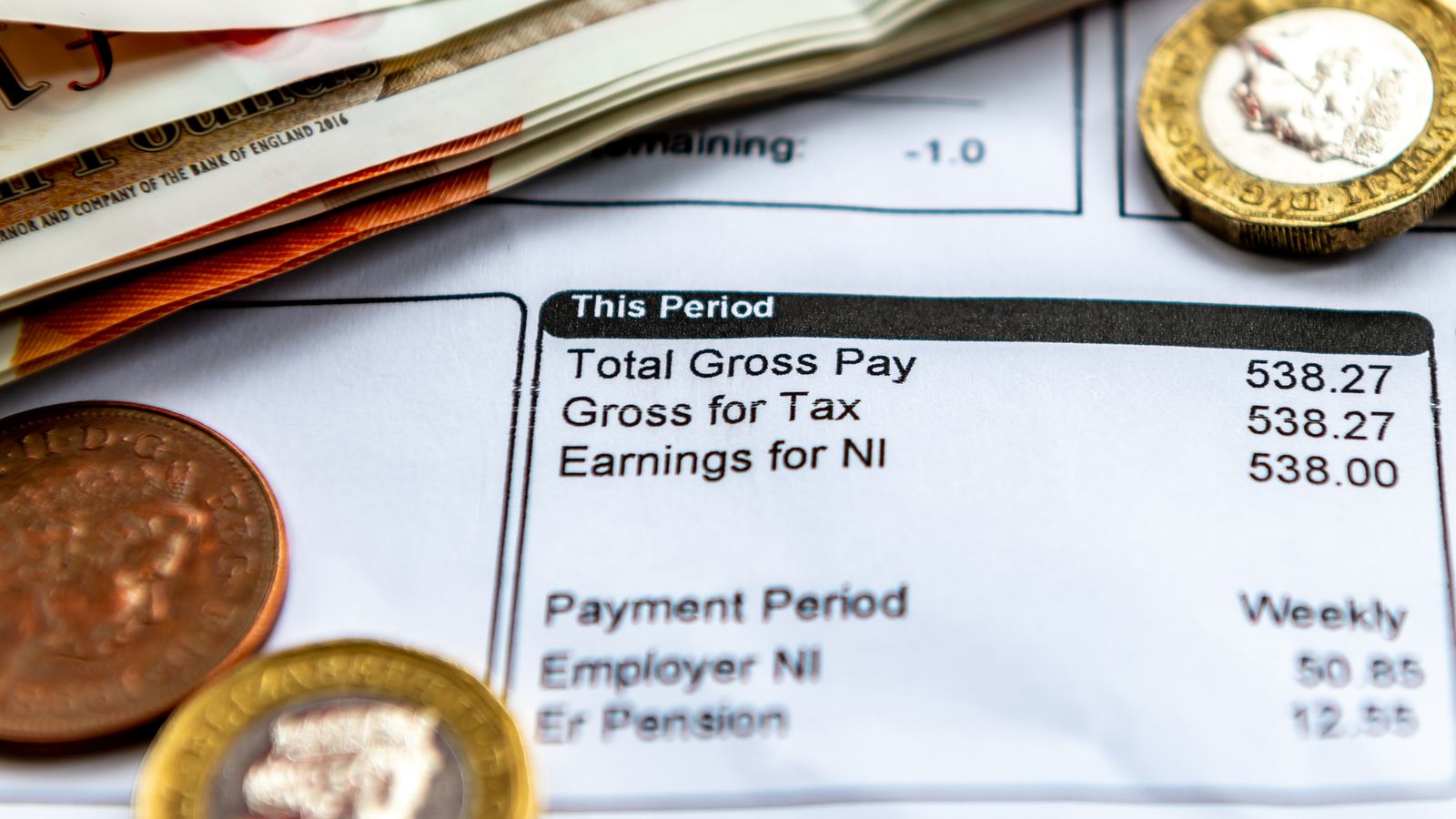

Salary sacrifice schemes allow people to give up a chunk of their salary for a different benefit from their employer.

This could be for a company car, a cycle to work programme, childcare vouchers, healthcare or a pension.

When you give up some of your salary, you do not pay income tax or national insurance on that amount, as it’s taken out of your gross salary before the taxes are calculated.

This can help bring your overall tax bill down and boost your take-home pay.

It’s helpful for your employer as well, as they don’t have to pay national insurance on the amount you sacrifice either.

Some employers choose to add this saving to your pension as well.

Here’s an example to explain how it works

Let’s say you earn £50,000 a year and you choose to sacrifice the minimum amount of 5% into your pension.

Each year, your employer would pay £2,500 of your salary into a pension, and your official salary becomes £47,500.

Your employer has to top up your pension by a minimum of 3%, so you get an extra £1,500 a year in your retirement fund, taking the total to £4,000 paid by your employer.

You would only pay national insurance and income tax on the remaining £47,500, so your tax bill would be £9,780.40 a year and your take-home pay would be £37,719.60.

If you didn’t use salary sacrifice but paid the same amount into your pension, your tax bill would be £9,980.40 and your take-home pay would be £37,519.60.

And your employer would save £345 on its national insurance bill, paying £5,299.20, instead of £5,644.20.

“Employees in workplace pension schemes will usually see three main payments deducted from their monthly salary before receiving their take home pay – income tax, employee NI and pension contributions. The same overall amount still goes into their pension, but depending on what type of scheme you’re in, your pension contributions may come out first, second, or third,” Charlene Young, pension and savings expert at AJ Bell, says.

“Crucially, both methods of income tax relief mean your own pension contributions are taken from your pay after your NI contributions have been deducted. But salary sacrifice rules let you make your own pension payment before interference from both NI and income tax.

“The main benefit to pension savers is that employee NI does not eat into their contributions. But the agreements do involve a cut on paper to someone’s pay, which could be important when it comes to things like being approved for a mortgage.”

What is Reeves going to do?

The chancellor is reportedly considering capping the amount of salary a person can sacrifice without paying national insurance at £2,000 a year.

Some suggestions have been made that the change could raise up to £4bn for the government.

For those earning up to £40,000 a year and sacrificing the minimum 5% into their pension, nothing would change, since the amount they are contributing would remain within the limit.

But for higher earners, who are more likely to use salary sacrifice to bring down their tax bill, it could have a major impact.

Financial services company Fidelity has a helpful example:

If someone earning £105,000 a year wanted to bring their pay below £100,000 to keep hold of various tax perks, they could sacrifice £10,000 of their salary into their pension.

Currently, no national insurance would have to be paid on that £10,000 by the employee or the employer, but if the cap was imposed, national insurance would have to be paid by both of them on £8,000.

That would mean the employee faces an additional £160 NI bill per year and the employer faces an extra £1,200 bill per year.

The Association of British Insurers and major pensions providers have urged Reeves not to take that step, warning the next generation of retirees is already at risk of being poorer than today’s.

Pensions industry bodies have warned that it could mean people and employers cutting back on the amounts going into pensions, storing up problems for pension savers and putting more cost pressures on businesses.

Yvonne Braun, director of policy, long-term savings at the ABI, says: “The industry has long-warned that we’re ‘sleep-walking’ into a retirement crisis. If the government goes ahead with suggestions to cap salary sacrifice, then we’re no longer sleepwalking, we’re speedwalking.”

Analysis by AJ Bell suggests someone aged 35 earning £50,000 a year could face a hole in their pension of £22,060 by age 65 under the plans.

The black hole rises to more than £37,000 or even nearly £50,000 if they are already a higher earner on £75,000 or £100,000 respectively.

Packaged milkshakes and lattes will be hit by the sugar tax, the Health Secretary Wes Streeting has announced.

The threshold for the Soft Drinks Industry Levy will also be reduced to drinks containing 4.5 grams of sugar per 100ml.

Streeting said the changes aim to tackle obesity.

“Obesity robs children of the best possible start in life, hits the poorest hardest, sets them up for a lifetime of health problems and costs the NHS billions,” he told the Commons.

The changes will include bottles and cartons of milkshakes, flavoured milk and milk substitute drinks, he said.

Companies will have until April 2028 to remove sugar or face the new charge, which he said would add £1bn in health and economic benefits.

Chancellor Rachel Reeves will formally announce the change at tomorrow’s budget.

The chancellor is reportedly preparing to give mayors the power to raise taxes by charging tourists on the cost of an overnight stay in their cities.

The UK is an outlier in not having tourist taxes in place already, the government says, and that’s true: Brussels, Lisbon, Amsterdam, Budapest and Barcelona are among the major European cities which already have some kind of levy in place.

Yet many of those cities also benefit from reduced VAT rates in their countries on things like overnight stays and restaurants.

That isn’t the case in the UK, where the standard 20% VAT rate applies across the board, meaning any potential tourist tax could leave quite the sting on the industry.

So, while staying in Lisbon might cost an extra €4 per night thanks to its tourist tax (see a list of others below), the VAT paid on an overnight stay in the city is still just 6%.

The trade body UKHospitality, which represents thousands of restaurants, hotels and pubs, said a UK tourism tax of 5% – the rate that will apply in Edinburgh from next July – would mean an effective consumer tax of 27%.

That figure includes the standard 20% VAT on a hotel stay, as well as VAT on the holiday tax itself, making it one of the highest tourist tax rates in Europe, the trade body said.

How much do other countries charge in ‘tourist tax’?

A number of popular European destinations already charge a tourist tax. Here are just some examples…

Sky News has launched a free Money newsletter – bringing the kind of content you enjoy in the Money blog directly to your inbox.

Each Friday, subscribers get exclusive money-saving tips and features from the team behind the award-winning Money blog, which is read by millions of Britons every month.

Sign up today, and this coming Friday you’ll find the following in the newsletter:

So join our growing Money community – and thanks to the thousands of you who already have.

Most Black Friday deals at some of the country’s biggest retailers are cheaper or the same price at other times of year, according to a Which? study.

In its study of last year’s Black Friday season, the consumer champion found eight out of 10 products were not at their best price.

It tracked 175 items from eight major retailers in the year to May and found 83% were cheaper or equal in price at least once outside the four-week Black Friday period (15 November to 12 December).

We’ve outlined the findings below – and some pretty robust responses from the retailers involved.

John Lewis was one of the worst culprits, with Which? finding 94% of products were cheaper or the same price at another time of year.

One example of an apparently dud deal found at John Lewis was a Samsung Jet Bot Robot Vacuum Cleaner, which was £350 on Black Friday, but had been £299 for 29 days in May and June 2024. It was £399 for 35 days in August to September, before jumping to £500 during the first week of October.

At Very, Which? found 93% of deals were cheaper or the same price at another time of year.

One of the examples researchers found at the online retailer was the Dyson V11 Extra Stick Vacuum Cleaner, which was £349 during the Black Friday period – but it was the same price on 29 days before and on 41 days after the sale.

At AO, 85% of Black Friday deals were at the same price or better at other times of the year.

Despite promising that sale items would not have been cheaper in the six months before Black Friday, 84% of deals at Currys were available for the same or a lower price in the six months before and after the sales period.

Which? also found that Amazon’s Black Friday deals were cheaper or the same price in 88% of cases, and cheaper in 63% of cases outside the sales period.

In contrast, Richer Sounds had by far the best performance in the analysis, with only 55% of analysed products found to be cheaper or the same price at other times of the year.

The investigation also uncovered evidence of retailers seeming to use recommended retail prices to make a deal appear more generous.

At Boots, Which? found an Oral B Vitality Pro Electric Toothbrush advertised as “save £25, RRP £50”, but the product was cheaper or the same price for more than 96% of the year. The £50 RRP was only in place for 13 days in the six months before the sale.

Reena Sewraz, Which? retail editor, said: “Our research exposes the harsh truth: for the majority of shoppers, Black Friday is a false economy. Retailers are relying on hype and urgency to push products that are the same price, or even cheaper, at other times of the year.

“There are good deals to be found but they can be few and far between. Our experts sift through thousands of deals every day during the sales to hand-pick genuine deals on products we think are worth buying. Our advice is simple: take your time, don’t be fooled by clever marketing and do your research.”

What did retailers have to say?

Amazon said it offered customers “great value all year round”.

“While Which? analysed just 24 products, Amazon’s Black Friday event offered hundreds of thousands of deals to customers in the UK. Additionally, a report in 2024 by Independent analysts Profitero, reviewed over 9,000 products and found that Amazon’s year-round prices are on average 15% lower than other online retailers in the UK. Customers can shop with confidence at Amazon, where they’ll find everyday low prices across a wide selection of products, all with the fast and convenient delivery they expect.”

AO said: “Customers know that Black Friday is now at least a month-long promotion and isn’t a single day. It’s still a brilliant time to buy and gives customers the opportunity to snap up a deal ahead of Christmas. That shouldn’t mean we can’t offer strong value year-round too – as these findings show, there’s great deals to be had at other times too. We welcome scrutiny that helps customers make informed choices, and our focus remains the same, delivering great value every day of the year, not just on Black Friday.”

Currys said it was “raising the bar” with its 2025 Black Friday sale, with every deal promising to be the lowest price ever offered.

“We acknowledge the observation made by Which? that the price of some Black Friday products can drop even lower at some point in the months that follow. This is normal and happens across retailers, as they compete, as new models are launched, and as clearance cycles run. We are satisfied that we have the right balance, offering a Black Friday deal set that is special without limiting our ability to give customers excellent offers all year round,” chief commercial officer Ed Connolly said.

John Lewis said customers could find brilliant deals all year round, and its Never Knowingly Undersold brand promise matched prices with 25 leading retailers: “Our Black Friday offer represents a great saving, and previous offers reflect us price-matching a competitor’s short-term promotion, to make sure we remain unbeaten on price.”

The Very Group said it was committed to delivering great value across its stores all year round.

Richer Sounds said it had a disclaimer on its website from early November until the close of our Black Friday promotion to say that anything marked as “Fantastic Black Friday Value” may have been at a lower price previously, but it was happy it still represented fantastic value.

“Where we marked up items as ‘our lowest price ever’ they meant just that – we’d never sold an item for less. The market may move after Black Friday and if this is the case, we will always look to pass any extra savings on to our customers,” it added.

Boots said it offered discounts on more than 20,000 products across the Black Friday period last year.

“Being part of that promotional programme does not preclude those lines from being on offer at other times throughout the year, as we strive to deliver great value for money for our customers every day,” it added.

The chancellor is set to announce a cut to the annual cash ISA limit in the budget tomorrow, hoping it will encourage more people to invest in the UK stock market and boost the economy.

Rachel Reeves has decided to reduce the limit to £12,000, down from the current limit of £20,000, according to the Financial Times.

Those close to her preparations also said she had dropped plans for a voluntary type of “Brit ISA” after receiving backlash from ISA providers and the UK’s Investment Association trade body.

The chancellor held weeks of consultation with the industry, and determined that there was little support for the creation of the Brit ISA.

Such a move would have given investors an extra £5,000 allowance to invest into UK shares, but there were concerns it would complicate the market.

“The idea had a poor reception and there was a general feeling that we didn’t really need to do it,” one person involved in the talks said.

But concerns remain about reducing the cash ISA limit.

“While investment in the markets does historically tend to deliver better returns over time, which is why we still support the government’s drive to encourage more investment, we believe the focus should have been on incentivising investment rather than penalising savers,” Victor Trokoudes, founder of cash ISA provider Plum, said.

“Savers now need to make sure they use up as much as possible of their cash Isa allowance to avoid tax on interest.

“If you have savings in a standard savings account that are taxable, now is the time to move them to an ISA.”

Every Tuesday, we get an expert to answer your financial problems or consumer disputes – you can WhatsApp us here or email moneyblog@sky.uk. Today’s is…

My husband was born on 28 June 1959 and began working in September 1975. We were married on 1 September 1979, and I was born on 28 February 1959. As our family grew, we decided that I would stay at home to raise our three children, as my husband was the primary earner.

Sadly, my husband was made redundant in June 2020 and passed away on 15 February 2023, before reaching his state pension age. Throughout his working life, he paid national insurance contributions for approximately 45 years.

I began receiving my state pension in February this year, but I was surprised to find that I am not receiving the full amount. I have been advised that I am not entitled to inherit any portion of my late husband’s pension or contributions, which I find difficult to understand.

Could you advise whether any part of my husband’s NI contributions – particularly any protected payments or entitlements – could be applied to increase my pension?

Yvonne Smith

Thanks for your email, Yvonne, and I am very sorry for your loss. Dealing with pensions can be an overwhelming task, especially when you’re not in a “typical” circumstance.

When the new state pension was introduced, the system was overhauled with the aim of getting people to build up their own pension benefit, based on the national insurance contributions they had made.

Anyone reaching state pension age on or after 6 April 2016 receives this version of the state pension.

Due to the changes, there’s now little wiggle room for people to inherit state pension contributions.

But I spoke to Charlene Young, senior pensions and saving expert at AJ Bell, who pointed out that because you were married before 6 April 2016, you can inherit up to 50% of any protected payment your husband was set to receive.

What is a protected payment?

There are rules to make sure people who built up most of their NI record before the changes get no less under the new regime than they would have under the old rules, Young explained.

“Put simply, the DWP will take the highest pension amount under the old versus the new system. Any extra amount someone is entitled above the new full, flat rate of £230.25 is called a protected amount,” she said.

Young gave this example:

If your husband would have received a state pension of £12 above the standard, full flat rates, you could inherit 50% of this, equivalent to £6 a week, on top of your own state pension.

If your husband was ever “contracted out” in his working life, then it’s unlikely he would have built up a protected payment, and this would mean there is nothing to inherit from his state pension record.

But he might have had additional pension benefits (outside the state pension) thanks to contracting out. You should have been able to inherit any unused pension pot, or receive a spouse’s pension, depending on the type of workplace scheme he was in.

Check your credit record

You stopped working when you started your family, and Young noted that if you were claiming child benefit during that time, you would have still been able to build up your own state pension record.

This is thanks to Home Responsibilities Protection (HRP), the forerunner to the national insurance credit system.

“The DWP has made many errors when it comes to underpaying state pensions to women, including errors with HRP. This is because people claiming child benefit before 2000 didn’t have to include their NI number when applying for it, meaning records were not always full,” Young said.

She urged you to double-check your NI record for gaps between 1978 and 2010, particularly in those years you stayed at home to raise your children.

The quickest way is to do this online. If you have missing HRP, you could be entitled to a cash payment to correct things.

“The second step is then to press the DWP on whether your husband would have expected a protected payment had he reached state pension age, as you would be eligible to inherit 50% of that on top of your state pension,” she said.

This feature is not intended as financial advice – the aim is to give an overview of the things you should think about. Submit your dilemma or consumer dispute via:

As always, we’ll leave you for the day with some additional reading – all about pensions.

It’s a subject people young and old engage with – but the jargon can leave even the savviest Money blog reader scratching their heads.

Explained

Over the last few months, we’ve looked at the pros and cons of the two main options for getting your pension: drawdown and annuity…

One of the most common questions we are asked is why there are two kinds of state pension, depending on your age. Read the answer here…

We suggested at the top of this post that it isn’t just older readers who care about this topic. This post, on how much temporarily pausing your pension contributions could cost you in the long term, was popular…

Further reading

A few months ago we brought you an exclusive on how a common error by employers could leave women who go on maternity leave out of pocket in retirement…

And earlier this year, we looked at how 2.3 million people are missing out on extra money for their pensions.

A total of 56% of workers who are paying higher or additional rates of tax pay into a personal pension – but 46% of those people do not claim pension tax relief on their contributions, investment platform InvestEngine found.

Read more here…

The chancellor is set to announce full student loan support for those who leave care to go to university in the budget this week.

Care leavers are considered much more likely to drop out than other students, with only 14% of young people who leave care going to university.

Rachel Reeves is expected to confirm on Wednesday that all care leavers will become eligible for the maximum maintenance loan, worth up to £13,500.

Automatic entitlement to the maximum student support for care leavers under the existing system is limited to those on the lowest incomes, under 25 and are without a partner.

“This commitment is a vital step towards removing financial barriers for care leavers,” Fiona Ellison, director of the Unite Foundation, said.

“Guaranteeing full student loan support for all care leavers sends a powerful message that higher education is for everyone, and it gives young people who’ve faced the toughest starts in life real hope for their future.”

Fast food chain Leon is ending its coffee subscription scheme after less than two years.

The £25-a-month Roast Rewards scheme gives subscribers five drinks a day made by baristas as well as 20% off food.

It will end on 31 December as part of an overhaul of the business by co-founder John Vincent, with subscribers receiving Leon Club loyalty points.

The wider plan would see Leon return “to its original purpose”, Vincent said.

“For me, that means getting back to serving food and coffee that’s good for you, good for our teams and good for the planet,” he explained.

“Coffee is a big part of that, but the subscription has driven a level of volume our teams are struggling to keep up with. It’s affected their day-to-day, and it’s affected your experience too.”

Leon will reinvest in coffee innovation, with plans to launch several coffees next year with ingredients with added health benefits.

Baristas will also undergo training of wing tsun – an ancient martial art – after it was previously rolled out across the business.

According to Leon, it helped cut 30 seconds off the time it took to make six perfect coffees.

Be the first to get Breaking News

Install the Sky News app for free