SiriusXM entered Q4 with renewed confidence, raising guidance after a flat but resilient third quarter that saw record free cash flow, rising ad and podcast revenue, and the groundwork laid for addressable in-car advertising and a new era of digital growth.

Total revenue for the quarter reached $2.16 billion, down less than 1% year-over-year, while net income rose to $297 million. Free cash flow surged to $257 million, up sharply from $93 million in Q3 2024, driven by lower capital expenditures, reduced tax payments, and the absence of prior Liberty Media transaction costs.

SiriusXM CEO Jennifer Witz said the company is raising full-year guidance by $25 million across revenue, EBITDA, and free cash flow, citing improved operating performance and efficiencies. “We are confident improvements in our business will drive continued growth in free cash flow towards our target of $1.5 billion by 2027 and beyond,” she said.

CFO Tom Barry highlighted cost savings as a key contributor to the quarter’s results. Sales and marketing expenses dropped 15% to $176 million, while product and technology costs fell 5%. The company achieved more than $200 million in annualized cost savings in 2025, hitting its target ahead of schedule.

Subscriber revenue declined to $1.63 billion, while advertising revenue climbed to $455 million, a 1% gain year-over-year. Within the company’s core satellite segment, total revenue slipped 1% to $1.61 billion, primarily reflecting lower self-pay subscriber counts and reduced marketing spend on streaming promotions. Average revenue per user rose slightly to $15.19, aided by a March rate increase, while churn improved to 1.6%, driven by lower vehicle-related turnover.

The company recorded 40,000 self-pay net losses in Q3, consistent with prior expectations.

SiriusXM’s Pandora and off-platform division posted $548 million in revenue, up 1% from the prior year. Podcasting revenue grew nearly 50%, continuing its multi-quarter streak of double-digit gains, offsetting declines in streaming ad performance.

Witz said the company’s expanding Podcast Network is a major growth engine. “Podcasting in particular continues to boom, once again up almost 50%, offsetting declines in music streaming.” SiriusXM added new creator deals with SmartLess Media and Mr. Ballin, and began integrating Amazon DSP to scale its programmatic ad business.

SiriusXM also continued to invest heavily in its in-car experience, expanding its satellite/streaming hybrid 360L platform to more automakers. The company’s shift to a customer-based subscription model, replacing the old vehicle-based framework, also began rolling out this quarter. The change allows subscribers to keep their accounts active when switching vehicles, eliminating friction that often led to churn.

SiriusXM further confirmed that addressable in-car ad replacement will begin rolling out in early 2026. Executives said this will make SiriusXM “the only provider able to execute against addressable inventory in the car.”

Looking ahead, the company’s new ad-supported tier is reportedly seeing early success without cannibalizing higher-priced subscriptions. Witz said initial tests have driven signups across all package levels. “There’s no evidence of cannibalization of our existing full-price population,” she said. “Within the test population, we are driving interest and subscriptions across all our packages, effectively widening the top of the funnel.”

Share via:

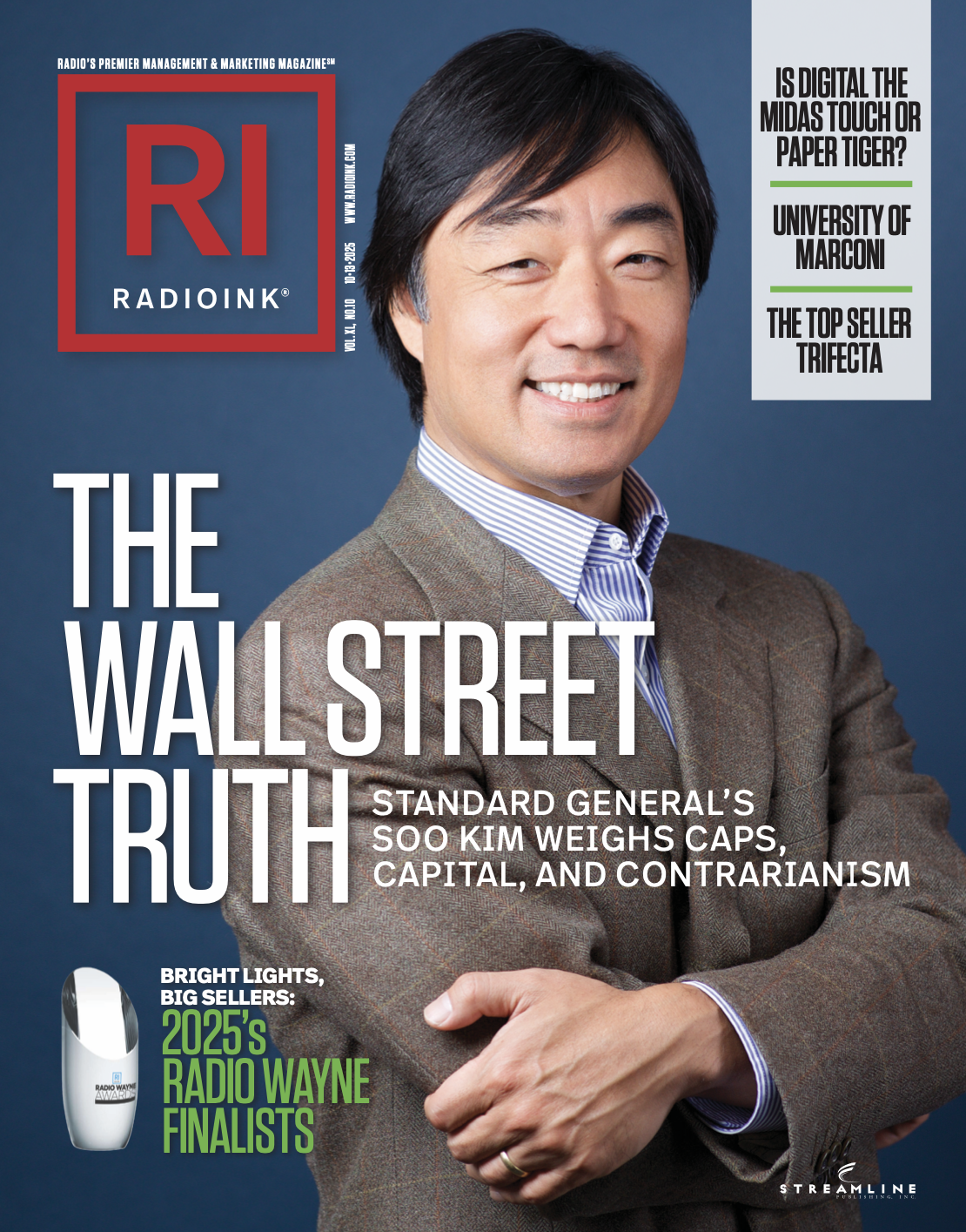

Standard General’s Soo Kim

2025 Radio Wayne Finalists

Digital: Midas Touch or Paper Tiger?

SUBSCRIBE

Daily industry headlines plus breaking news bulletins.