EV uptake is often described as following the traditional ‘S’ curve that was popularised in Everett Rogers’ seminal 1962 book Diffusion of Innovations. In it he described a model for how, why and at what pace new ideas and technology spread.

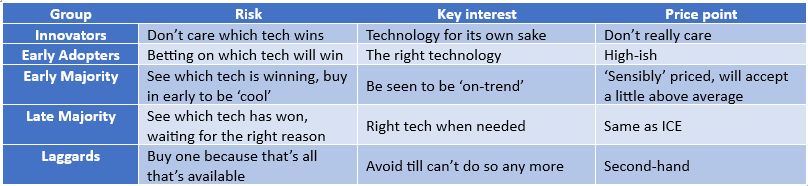

Associated with that curve are his definitions of five distinct types of buyer/innovator – each said to have noticeably different reasons, motivations and social connections that materially affect their willingness to adopt a new technology or innovation.

So what does Rogers’ model offer us in understanding how the EV transition is evolving … and how the latest crop of EV buyer interact with their information and communication sources?

First-up, it has been theorised that once an innovation moves from Early Adopter to Early Majority (in this case, at around 16% of new car buyers buying EVs) the point of ‘critical mass’ has been reached. In other words, adoption has effectively become ‘unstoppable’.

With China surpassing 40% of new cars sold being EV and Europe overall reaching 32% in August (21% BEV, 11% PHEV), that point has certainly been passed in two of the world’s biggest markets.

In fact, by the end of this year the world overall is looking at 1 in 4 new vehicles sporting an electric socket! Going by the model’s predictions, it’s time to say ‘game over’ for ICE in the long run.

So do the people buying BEVs change as sales grow? ‘Pocket depth’ has definitely been one driving factor – BEVs were eye-wateringly expensive in the early phases and only those with significant financial resources could afford them … even if they wanted to.

BEVs are now getting much cheaper, so people with more modest means can now also afford to consider one. The point is though, do they want to consider one? And what is the difference between someone who does consider one versus someone who won’t?

This is where Rogers’ Diffusion of Innovations model comes in. Whilst many a learned treatise has described these groups in great detail, I’ll summarise them under a couple of dimensions only:

So what does the model have to say about who is buying an EV and when?

At the start, they could be expensive and have technology battles – the Innovators love that sort of thing and can afford to pick the wrong side.

Early adopter love tech too – but don’t want to be left with a lemon, so they wait till the battle is firmly heading one way or the other before taking the plunge. For both of these groups (despite their grumblings) price is generally not an issue. (And didn’t the EV manufacturers love that, keeping prices high until the recent limited price wars started and they had to drop … a bit).

However, overseas the BEV market has moved well into the Early Majority. Early Majority buyers have not only waited to see which is the likely majority winner out of BEV/PHEV or hydrogen, they have wanted prices to drop enough to meet their budgets.

The Chinese have certainly been taking the play up to this group by introducing lots of high-spec, reasonably (though not budget) priced BEV models. The Chinese after all been working hard for some time to get the economies of scale up in their own market first, so can afford to lower the price and still make a profit.

The European makers have been catching up though with models like the Dacia Spring, Renault Twingo and Fiat Grand Panda now available (none of which are sold here), with more to come soon from VW and others.

The Early Majority also want to be seen to be ‘cool’ by buying their BEVs, so don’t like being associated with controversy (Elon Musk take note) or complications that detract from the experience.

That latter point is something policy makers need to take note of if they want to smooth/hurry up the transition away from ICE vehicles. Policies in this area would be ones making charging easier and more available, as well as supporting the rollout of charging in trickier circumstances such as apartments, as well as needed ones like workplaces.

Looking forward from here: Australia is late to the Early Majority party and it is likely it won’t be before mid-2026ish before we hit the 16% marker. So expect late next year to see a slew of them under $30k with new marketing strategies aimed at making BEVs loaded with features cool to be seen in.

As for the Late Majority – well, it will be obvious to all that the game is over for ICE when new sales hit 50%, but manufacturers will have to drop prices to keep sales going smoothly.

And the Laggards? Rogers’ model suggests it is perhaps better not to ‘poke the bear’. They hate change, and change advocates even more. Trying to get them to change is only likely to make them dig in further. Perhaps in time, when BEVs flood the second-hand market that are way cheaper to run and maintain, the Laggards will come over anyway. (Provided we didn’t get provoke them into manning the trenches beforehand).

By the way, innovation is an always happening thing! V2G is on the cusp of arriving, so it will be Innovators and Early Adopters all over again there – then autonomous vehicles, then flying taxis …

As a final note: if you’re interested in this and other EV Transition topics (and are free in Melbourne this Thursday, November 13th), why not come to the annual Australian Electric Vehicle Association sponsored EV conference? Being held the day before Everything Electric, it will be a good way to catch up on the latest EV topics and trends before checking out the Everything Electric Show.

I will by the way be there expanding on this topic, as well as on charging opportunities and issues and it would be great to meet you there. You can find the full program here.

EV conference tickets can be secured here.

Bryce Gaton is an expert on electric vehicles and contributor for The Driven and Renew Economy. He has been working in the EV sector since 2008 and is currently working as EV electrical safety trainer/supervisor for the University of Melbourne. He also provides support for the EV Transition to business, government and the public through his EV Transition consultancy EVchoice.

I agree to the Terms of Use

I agree to the Terms of Use

Input your search keywords and press Enter.